Managing Emerging Risks in the Face of Global Uncertainty

Emerging risks—both new risks and familiar risks in unfamiliar conditions—have taken on new meaning and importance in today’s increasingly uncertain world. As the unimaginable global impact of events such as the euro crisis, the subprime mortgage crisis, the tsunami in Japan, the Arab spring uprisings, Hurricane Sandy, flooding in Thailand, and other events caused damage beyond what could have been predicted, emerging risks have earned the attention of executives and board members in corporations around the world.

Emerging risks—both new risks and familiar risks in unfamiliar conditions—have taken on new meaning and importance in today’s increasingly uncertain world. As the unimaginable global impact of events such as the euro crisis, the subprime mortgage crisis, the tsunami in Japan, the Arab spring uprisings, Hurricane Sandy, flooding in Thailand, and other events caused damage beyond what could have been predicted, emerging risks have earned the attention of executives and board members in corporations around the world.

The challenges have become:

- How to effectively detect and evaluate emerging risks

- How to build processes that effectively mitigate the most important, relevant, and likely risks

- How to enable better decision making related to the potential impacts of emerging risks

Despite the high level of attention and investment around emerging risks, a 2010 Oliver Wyman global survey of 650 senior executives of large global companies, found that most respondents believe their risk management practices do not provide meaningful information to enhance decision making. Sixty-two percent of respondents rated their organization as “ineffective” to “moderately effective” at integrating emerging risk information into their operations. Only 38% consider their organization “very effective.” Similarly, executives surveyed said their risk management practices are least effective across the critical areas of operational planning, capital allocation, and strategic planning.

In our view, these numbers have not changed dramatically since that 2010 study.

Understanding Today’s Global Risks

The World Economic Forum recently released its Global Risks 2013 report, developed from an annual survey of more than 1,000 experts from industry, government, academia, and civil society who were asked to review a landscape of 50 global risks.

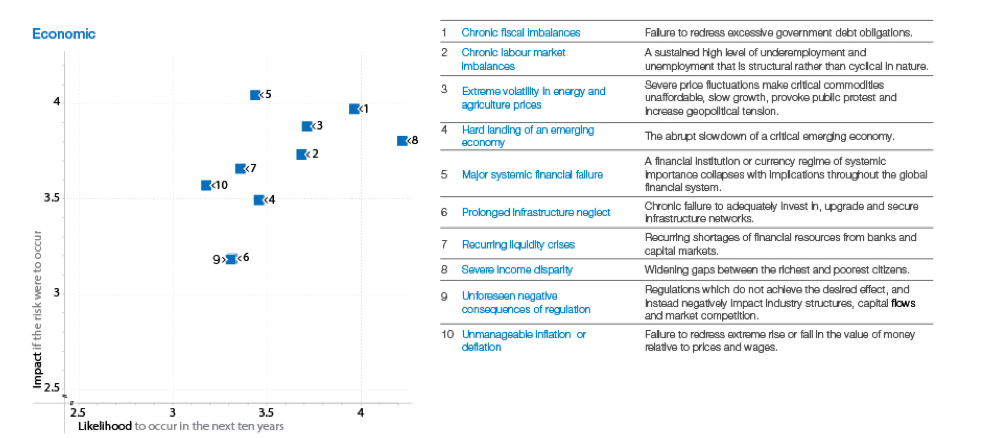

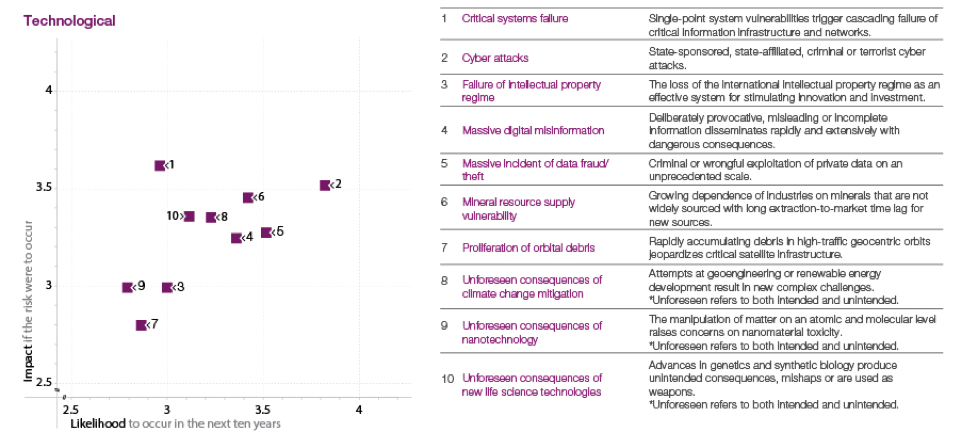

Respondents identified those risks they felt were most likely to manifest over the next 10 years (severe income disparity ranked number one) and also which would present the greatest impact if they were to occur (major systemic financial failure ranked number one in this dimension). Here we show results across two key categories of interest to a typical enterprise: Economic and technological.

These results can offer a valuable starting place for organizations striving to better identify, understand, measure, and prioritize the potential losses associated with potential new risks.

Building Resilience

An organization must build a capacity to face the emerging global risks that threaten its people, brands, and profits.The World Economic Forum report states it well, “The hyper-connected nature of the modern world makes it increasingly urgent to understand how best to build resilience in the face of global risks.”

At Lowers Risk Group, we provide comprehensive enterprise risk management solutions to organizations operating in high-risk, highly-regulated environments and organizations that value risk mitigation. We’re here to help you take the next step in managing the emerging risks that face your organization and the world at large. Request a meeting.