As the ACFE’s 2019 Fraud Awareness Week comes to a close, it’s a good time to create your plan for fraud prevention in the year ahead. These seven fraud prevention strategies, drawn from the 2018 Report to the Nations by the Association of Certified Fraud Examiners (ACFE), will go a long way in fortifying your organization against the conditions that can facilitate occupational fraud at the workplace.

1. Tone from the Top

A robust anti-fraud program that is embraced from the top of the organization to the bottom creates a culture of honesty and fairness. A solid program starts with a code of ethics, signed by all employees, and continues with anti-fraud policies, training, internal controls, and periodic employee surveys which help gauge the extent to which employees believe management acts with honesty and integrity. Many organizations also include fraud prevention objectives as a part of their employee performance goals.

2. Anti-fraud Training

Practical, hands-on training that educates employees on how to detect fraud, what to look for, how internal controls work, and how to report fraud are instrumental to any anti-fraud program. For instance, make employees aware of the research that demonstrates how fraudsters attempt to conceal their activities, such as through the creation of fraudulent documents, altered accounting transactions, or fraudulent journal entries.

3. Clear Reporting Methods

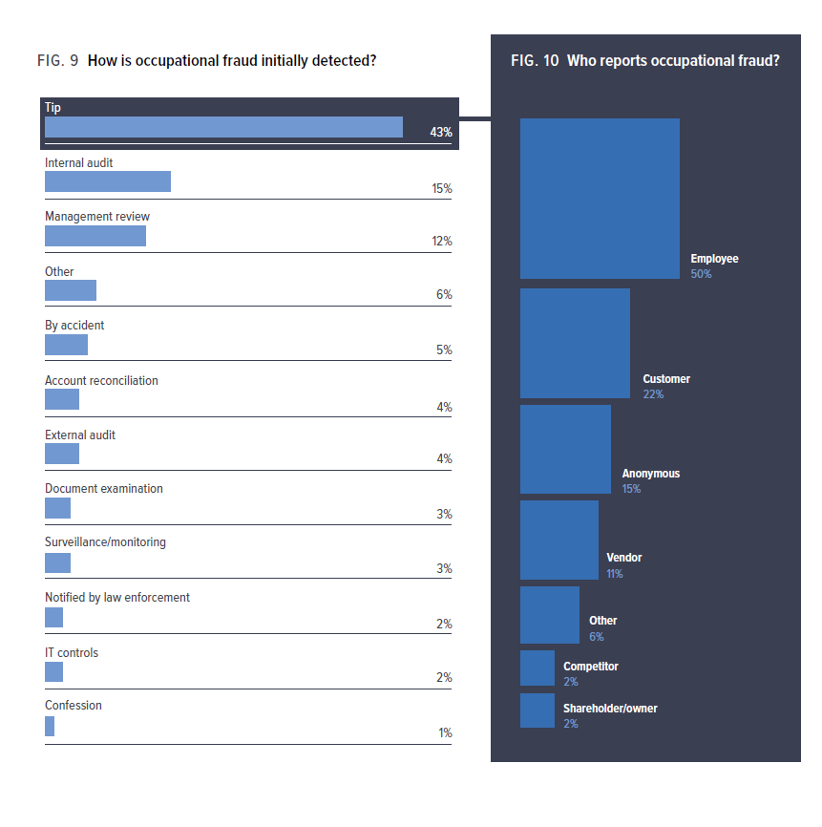

Fifty-three percent of fraud cases in the ACFE’s 2018 Report to the Nations were reported by employees, and the research also revealed that hotlines were effective in encouraging such reporting. So, whether you create a dedicated fraud hotline, or rely on emails, web forms or in-person reporting, do be sure that all employees know their options for reporting suspected fraud.

4. Proactive Detection

Commit to having anti-fraud efforts remain at the forefront of your organization. This means sending out regular messages to the team, conducting surprise audits, performing regular account reconciliation, and implementing continuous monitoring software to detect anomalies. Organizations with proactive detection methods like these caught fraudulent activities months earlier than those with passive detection. For example, frauds detected actively by IT controls tended to last five months and cause a median loss of $39,000, compared to schemes detected passively (e.g., through notification from law enforcement), which tended to last two years and cause a median loss of almost $1,000,000. If you’re not sure where to start, begin with a fraud risk assessment to identify and mitigate any vulnerabilities you find.

5. A Strong Auditing Team & Internal Controls

The one-two punch of a strong auditing team and solid internal controls will mean the difference between sleeping well at night or potentially having massive losses. Your auditing team should have adequate resources and authority to operate effectively and without undue influence from senior management. In addition, the ACFE’s 2018 study found that weaknesses in internal controls were responsible for nearly 50 percent of all fraud cases! Anti-fraud controls are paramount to preventing or detecting fraud. Here are a few of the most important controls:

- External audits of financial statements

- Internal audit department

- Management certification of financial statements

- External audit of internal controls over financial reporting

- Management review

- Reporting hotline

- Code of ethics and anti-fraud policy

- Proper separation of duties

- Job rotations

6. Diligent Hiring Practices

Background checks should always be a part of any hiring practice, and attention to criminal history, credit reports, and reference checks are particularly important in the context of preventing fraud. However, since 96 percent of fraud perpetrators in the AFCE study had no prior fraud conviction, the next step is understanding the behavioral red flags associated with fraudsters. Eighty-five percent of perpetrators displayed at least one of these red flags: living beyond means; financial difficulties; unusually close relationship with vendor/customer; control issues, unwillingness to share duties; divorce/family problems; and a “wheeler-dealer” attitude.

7. Employee Support Programs

Employee support programs are valuable for a variety of reasons, but in the context of occupational fraud, they can help address some of the underlying issues that present themselves as “red flag behaviors.” An open-door policy that welcomes employees to speak freely about financial, family or addiction pressures can help alleviate them before they become acute or lead to destructive behaviors.

The most cost-effective way to limit fraud losses is, of course, to prevent fraud from occurring. With these strategies in-hand, your organization will be off to a strong start. If you’d like an experienced team to help create an anti-fraud program or investigate suspected fraud, please reach out at any time.