Organizational Fraud: The Motivation to Steal

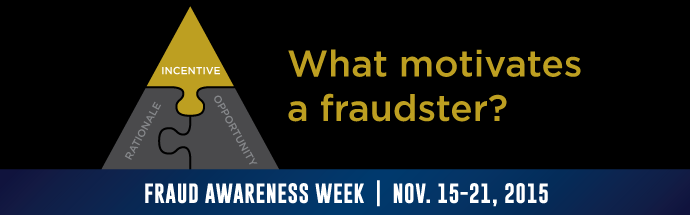

Ordinary people can do extraordinary things, including committing fraud. The question is, what motivates an ordinary person to morph into a fraudster?

“Pressure,” or motivation, is one of the three causal factors of Donald Cressey’s Fraud Triangle, along with opportunity and rationalization. A quick summary of the theory is that a person commits fraud when under difficult or threatening personal circumstances (pressure) and he or she has access to a valuable target for personal gain (opportunity) that they can justify internally (rationalization).

The pressure factor in fraud risk is idiosyncratic and dynamic. Individuals’ circumstances are as highly varied as their perceptions and reactions are to them. The main thing is that the propensity for fraud emerges when a person’s circumstances create perceived pressure that leads him or her to exploit an opportunity when it appears. In other words, every person in every organization has the potential to commit fraud under the right combination of circumstances.

This assessment is not as bleak as it sounds. In the first place, pressure is less likely to lead to fraud in organizations where fraud is taken seriously and fraud training is provided to employees. For example, regular interviews with employees about their personal circumstances may lead to uncovering situations that could add pressure that would lead to fraud. Especially given that the preponderance of fraud is motivated by financial pressure, it may very well be that a policy to address and help the individual could help to avoid fraud.

Trust but verify.

Broadly, organizations need to “trust but verify.” Frauds are committed at all levels of the organization, but at each level there are certain red flags that should raise awareness of the individual’s potential threats. In the 2014 ACFE Report to the Nations, actual cases of organizational fraud were analyzed to identify the personal circumstances of the fraudster to see which red flags might have alerted the organization. The most common factors were:

- Living beyond their means. (This was the most common red flag by far, showing up in 44% of the cases.)

- Financial difficulties, accounting for 33% of cases.

- Unusually close association with a vendor or customer (22% of cases).

- Control issues, or an unwillingness to share duties (21% of cases).

Numerous other issues were associated with fraud, including family problems, addiction, employment-related problems, and excessive job pressure. Notably, past legal problems, including prior convictions, were not highly associated with fraudsters, a further piece of evidence that fraud is a crime of ordinary people in extraordinary circumstances.

Given that there is some variation in red flags by position, understanding these trends can help an organization tailor counseling and interview interventions. For example, people at every level were vulnerable to living beyond their means, but owners and executives were much more likely to have “wheeler-dealer” attitudes or control issues.

The motivations that compel crime change during the course of an individual’s life. That’s why a long time employee may suddenly turn out to be a fraudster, to everyone’s surprise. Organizations that take an interest in employees’ lives are much better positioned to intervene to prevent a fraud.