The Red Flags of Fraud You May Not Know

It would be really good to know who in your organization is most at risk of perpetrating a fraud. You could then take steps—counseling, reviewing controls, rotating jobs—to protect against that risk.

Theoretically, the Fraud Triangle does a good job of stipulating who might be a fraud risk. It says people are more likely to commit an occupational fraud when they have motivation, opportunity, and a rationale to excuse their crime. The rationale is an individual factor which organizations cannot address in advance, but there can be indicators based on motivation and opportunity.

The 2018 Report to the Nations on Occupational Fraud and Abuse contains some concrete information that is consistent with this theory. In research for the Report, the Association of Certified Fraud Examiners (ACFE) identified 17 behavioral “red flag” traits that might be associated with a perpetrator of fraud. These are primarily indicators of motivation or pressure that may cause a potential fraudster to flip into active fraud.

85% of the fraudsters in the 2,690 cases ACFE reviewed had at least one of the red flags, and 50% had more than one. They are at least somewhat predictive.

The most common red flags have to do with financial difficulties (motivation, pressure). Since 2008 when the first edition of the Report was published, the six top red flags, in order, have consistently included:

- Living beyond one’s means

- Financial difficulties

- Unusually close association with a vendor or customer

- Control issues, unwilling to share duties

- Divorce/family issues

- “Wheeler-dealer” attitude

Much is written about these common behavioral red flags of fraud, but there are other red flags organizations should be aware of when it comes to predicting and preventing fraud. So-called human resources-related red flags and non-fraud-related misconduct can offer valuable insight to those responsible for anti-fraud programs.

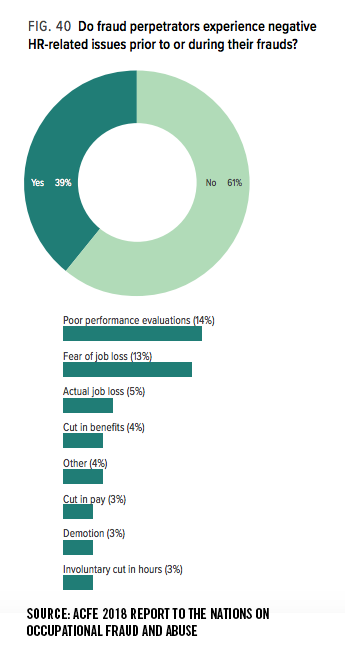

Human Resources-Related Red Flags

According to the ACFE’s 2018 report, 39% of fraudsters had experienced some form of HR-related red flags prior to or during the time of their frauds. The most common of these red flags were negative performance evaluations, and fear of job loss.

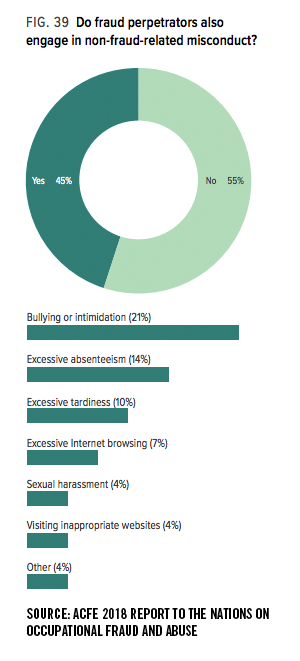

Non-Fraud-Related Misconduct by Perpetrators

According to the ACFE report, 45% of fraud offenders had committed some form of non-fraud workplace violation, which could potentially indicate a link between occupational fraud and other forms of workplace misconduct. The most common non-fraud violation was bullying or intimidation, which was observed in 21% of all cases.

To anticipate occupational fraud, the organization has to be well acquainted with its members at all levels of authority. Regular or routine evaluations (background checks, interviews, work reviews) would help to identify individuals at risk, and help them avoid failure. A fraud prevented saves the organization from damage to people, brands, and profits.