Emotional Intelligence & The Allure of Insurance Fraud

By Neil Watson and Keith Gray

Insurance loss happens for many reasons. For a business, common causes include armed robbery, theft, customer injury, floods, fires, and storm damage; but any natural disaster, large-scale event, or man-made act can bring about a claim. When an event involves the loss of physical stock or damage to property, the loss is immediate, and it creates an urgent need for the business owner to settle the claim so that the business can resume operations and avoid further lost revenue.

This desire to quickly return to business as usual is a natural one, but in the wake of an event, it’s not uncommon for the resolution process to test the business owners’ resolve. And while most claims post-incident are legitimate, from time-to-time, human emotions will complicate the process and create an environment that enables fraudulent activity, sometimes in unexpected ways.

Why Does Insurance Fraud Happen?

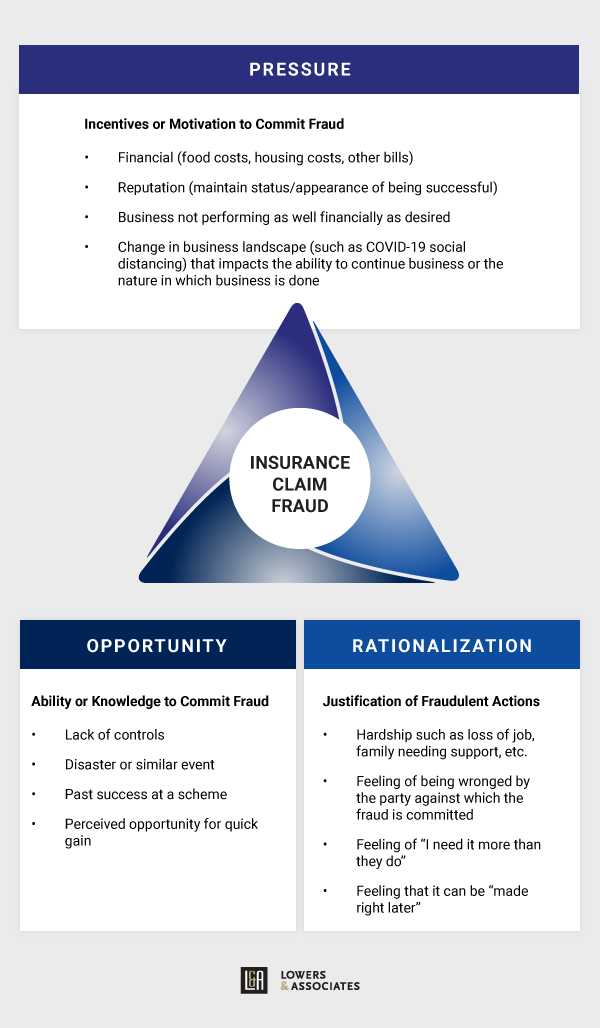

The Fraud Triangle provides all the insight required to answer this question. Our team has written extensively on this, but Donald Cressey’s hypothesis in his book “Other People’s Money” says it all: Trusted persons become trust violators when they conceive of themselves as having a financial problem which is non-shareable, are aware this problem can be secretly resolved by violation of the position of financial trust, and are able to apply to their own conduct in that situation.”

It’s true that some fraudulent claims start out as legitimate but become ‘exaggerated’ during the claims process due to perceived opportunity. In other cases, if the business is not doing well and is losing money, desperation can create enough pressure to commit fraud. In rare cases, the fraud may involve large organized criminal gangs; these are often well-planned and involve multiple parties where the sole intent of the activity is a rational attempt to defraud an insurance provider.

It’s for these reasons that impartial guidance through the claims process is crucial. As an insured, it is important to work closely with your insurance broker and the loss adjuster in preparing your claim and validating your losses. Without this professional assistance and oversight, fraud can easily find its way into the conversation.

How Does Insurance Fraud Happen?

Below are a few examples of insurance fraud we’ve seen over the years at Lowers & Associates:

- ‘Padding’ legitimate claims to increase the claim amount

- Including losses from previous shortages or events within a big ‘single event’ claim

- Manipulating inventory, possibly running two sets of books, to allow for the tracking of actual inventory versus the falsely reported inventory

- Exaggerating the damage suffered as a result of a natural disaster (storm), or even causing some additional damage not caused by the original disaster

- Committing arson

- Staging accidents or thefts

The current COVID-19 situation globally, coupled with other localized events (recent looting losses in the U.S. or the extreme poverty facing certain areas in Brazil), is resulting in retail sales for certain sectors falling by over 50% and as much as 100%, which is clearly not sustainable.

In such unprecedented times as these, the possibility of a spike in fraudulent claims is a real concern. There is an increase in both the pressure and opportunity factors, resulting in an increased likelihood that potential perpetrators may rationalize their fraudulent thoughts and act on them as a result. For business owners, it can be hard to find consistency and understand what their default problem-solving steps should be. When the Lowers & Associates team is presented with uncertainty, we often lean on process and procedure to identify a way forward in our work together with clients. This path can always be informed by intuition, experience, and empathy, but for a business, without process and procedure to provide impartiality, the risk of insurance fraud increases significantly.

What Can You Do About It?

Ideally insurers would commission a pre-risk survey to establish security protections, stock levels, and standard operating procedures to satisfy themselves that the risk meets their requirements. While this is recommended, it is not always feasible due to time or cost restraints.

Post-event, once a claim has been filed, relying on the findings of a law enforcement investigation may not be feasible due to timing or any related circumstances related to the event (especially if it’s large-scale or a natural disaster). And even if law enforcement is doing an investigation on an event, it may not be a priority, creating an extended period of uncertainty. Lastly, law enforcement may also be very hesitant to provide any info that they do have knowledge of, especially when it is an active investigation.

To manage this process, business owners and insurers need independent third parties that are flexible, have experience across multiple industries and can dedicate the appropriate time required to work through a claim (i.e. gathering facts, evidence and necessary documents) to support the basis of the claim. For truly complex fraud matters, business owners and insurers should expect the third party to have a Special Investigations Unit (SIU) with extensive experience in technical surveillance countermeasures (TSCM) and counterintelligence that regularly work on international assignments.

With enterprise risk mitigation and insurance solutions that include UAV/UAS, special investigations, forensic accounting, loss adjusting and more, Lowers Risk Group stands ready to support our clients through the claims process with the speed, accuracy and dedication you’ve come to expect from over 30 years in the business. To learn more, contact us.

About the Authors

Neil Watson brings nearly 30 years of insurance industry experience to Lowers & Associates, where he currently serves as Global Operations Director. With key insurance industry relationships in both the London and International insurance markets, Neil’s primary responsibility is to grow all verticals and assist in building out L&A’s claims adjusting capabilities.

Keith Gray has been with Lowers & Associates for over 15 years and currently serves as the VP of Client Relations. In his current role, Keith provides oversight with respect to program coordination, management of a nationwide team of industry professionals, investigation, and client communication. Keith possesses a degree in Accounting and is certified as both a Certified Fraud Examiner (CFE) and Certified Anti-Money Laundering Specialist (CAMS).