In our work in high risk industries, we routinely uncover fraud and asset misappropriations. While it may seem counterintuitive, with the US and global economy currently at a standstill due to COVID-19 shelter at home directives, organizations should be on high alert for occupational fraud during this time. The Fraud Triangle provides a framework for explaining why this is.

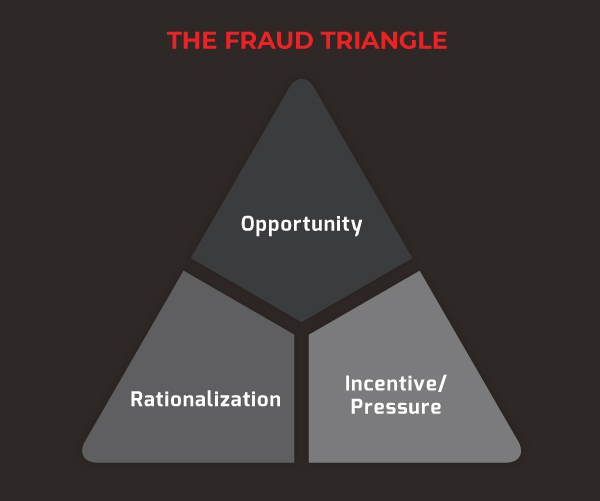

Formulated in 1953 by criminologist Donald Cressey, the Fraud Triangle theorizes that fraud occurs when the fraudster feels financial pressure, they are presented an opportunity, and/or the person can rationalize the theft.

With record numbers of Americans filing for unemployment and organizations operating with skeleton crews, the circumstances are ripe for fraud to take place.

A “Perfect Storm” of Conditions

Today, with organizations shut down to outside visitors (including, in some cases, outside auditors) as well as many employees, we are seeing a virtual petri dish for fraud. Two corners of the Fraud Triangle – opportunity and rationalization – are getting bent pretty hard. The third corner, incentive, in the form of extreme pressure, is bent even further. People have less supervision, more opportunity, and way more financial pressure.

So while you’re dealing with this pandemic and the resulting disruption, now more than ever is the time to be vigilant.

Opportunity

The coronavirus pandemic has driven unprecedented change in the workplace. Many employees are either laid off, have taken a pay cut, and/or are working remotely. Those who remain, whether at the workplace or from home, may be working with less supervision than before. In fact, we are seeing many instances where key risk management procedures like dual controls have been weakened or suspended entirely. For example, instead of having two or more employees independently evaluate and compare financial records, now only one employee may be responsible. Or, that supervisory signature normally required on certain transactions? It’s no longer practical given our remote locations, so we’ll just “do it this way” in the interim.

Sound familiar? The problem in these scenarios is that one small transgression that goes unnoticed has a way of snowballing into full-blown fraud.

Rationalization

When opportunity and incentive exist, people are better able to rationalize their fraudulent behavior. That couldn’t be more true than during this pandemic. “I have to do this to provide for my family. I’ll pay it back later. My employer deserves it for laying me off.” These are some of the underlying rationalizations that turn a fraudster’s underlying thoughts into an actionable theft.

Incentive/Pressure

Financial difficulties are at the top of the list in terms of the pressures that can motivate people to commit acts of fraud. At no other time in modern history have so many people been under such financial strain as they are today.

At the highest of levels of unemployment following the 2008 financial crisis, there were 15.3 million jobless Americans. By the third week of April 2020, 26.5 million workers had filed jobless claims as a result of the coronavirus. An estimated 33 million people are currently unemployed, representing nearly 21 percent of the workforce and the highest unemployment level since 1934. Many who remain employed have agreed to accept pay cuts, work reduced hours, or take unpaid furloughs.

While the $2 trillion stimulus bill, Coronavirus Aid, Relief, and Economic Security Act (CARES), provided some short-term relief, it is likely not enough to stem the extreme financial worry being felt by many who don’t know how they’ll pay next month’s mortgage or cover their car insurance premium.

The pressure is extreme.

The Takeaway? Stay Vigilant

It may be tempting for organizations to be complacent when the world seems at a standstill, but the time to be diligent is now. Businesses should be on “high alert” and taking measures to ensure they’re keeping their operations secure. That includes double checking that access to IT systems and software has been blocked for furloughed employees or that virtual private networks (VPNs) have been created for remote workers. Internal controls should also remain in place, even if they have to be modified temporarily. For example, regularly scheduled phone calls or video conferences send the message that you’re still monitoring employees’ activities. Finally, if you haven’t already done so, it’s a good time to do an updated risk assessment for the entire organization. Asking your team where new vulnerabilities might exist, whether internal controls are still functioning as intended, and what gaps have been created are all part of mitigating the risk potential associated with the Fraud Triangle.

If you’d like help conducting any of these assessments, please reach out to us.