Occupational fraud, referring to fraud caused by an organization’s own employees or executives, is among the most preventable fraud risks that a company faces. While preventable, this form of fraud is also one of the most prevalent in organizations.

To take a closer look at this phenomenon, the Association of Certified Fraud Examiners (ACFE) performs a bi-annual report. Its latest report, the 2018 Report to the Nations, studied 2,690 cases of occupational fraud across 125 nations. In addition to exploring its impact, the report looks at various fraud detection measures and their effect on the duration of the fraud and the size of loss incurred.

The ACFE report offers the latest stats on occupational fraud to inform your risk management and fraud prevention plans. Here are 8 notable findings:

1. Occupational fraud resulted in $7B in total losses in 2017.

The ACFE report identifies three categories of fraud: asset misappropriation, corruption, and financial statement fraud. Asset misappropriation was the most common type of fraud and occurred 89% of the time. However, financial statement fraud led to much greater median losses – $800,000 versus $114K median loss in asset misappropriation.

Of all asset misappropriation cases, altering checks and payments led to the greatest median losses, but billing fraud and non-cash were nearly tied for the highest overall incidences in asset misappropriation schemes.

2. Fraud cases resulted in losses greater than $1M or more in 22% of cases.

The 2018 ACFE report indicates that most companies either lose a relatively small sum (less than $200K) or a significantly larger amount. The differences are extreme. In 55% of cases, losses were below $200K, yet nearly a quarter of businesses incurred more than $1M in losses. The total loss values in between these two extremes were relatively less common, ranging from 2% to 11% in prevalence for this cohort. Of the 2,690 fraud cases examined, the median loss was $130K.

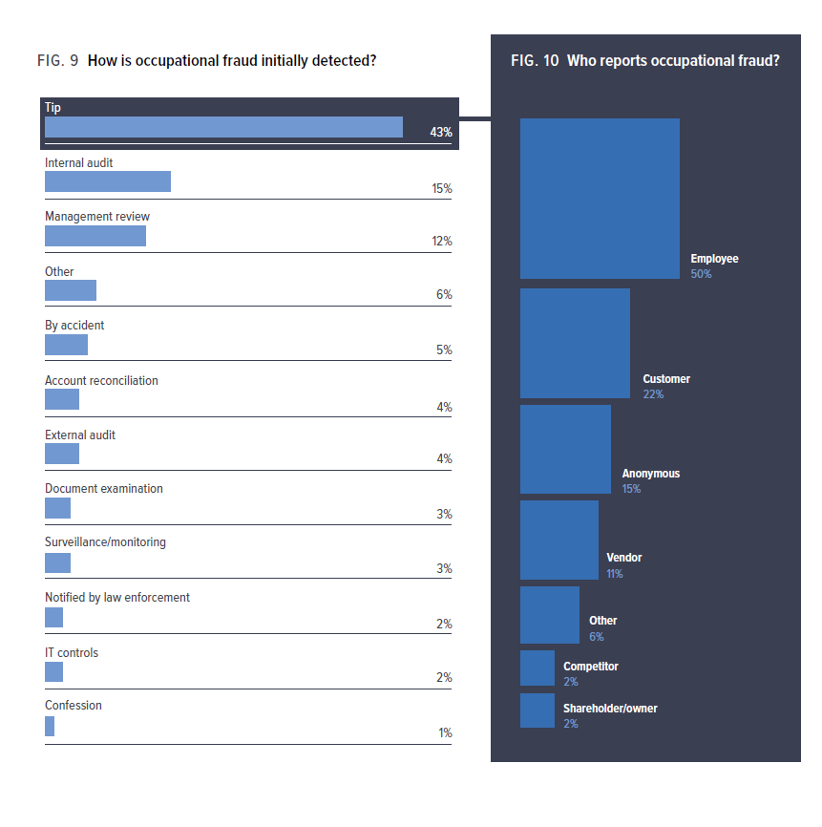

3. 40% of fraud cases were detected by a “tip.”

Early detection is key when it comes to limiting the losses associated with occupational fraud. According to the ACFE study, the vast majority of fraud detection (40%) comes from tips, which far surpasses the second highest detection source, internal audit (15%).

Tips can come from anyone, but generally they come from within the company. In ACFE’s report, 53% of tips were received internally whereas 32% were from an outside source. Hotlines go hand-in-hand with tips as an effective way to detect fraud. Of the companies analyzed, those with an accessible hotline detected fraud cases 46% of the time, compared to a 30% success rate for companies without hotlines.

4. 96% of occupational fraud perpetrators had no prior fraud conviction.

Detection activities should take place throughout an employee’s tenure. Only 4% of fraudsters in the ACFE’s study had a history of criminal fraud. This is important information, as a pre-hire background check is likely insufficient on its own in preventing fraud. These first-time offenders require active and effective detection efforts to continuously protect the organization.

The ACFE was able to identify the six most common behavioral tendencies shared among fraudsters:

- Living outside of one’s financial means.

- Financial hardship.

- Unnecessary levels of closeness to certain clients.

- Controlling tendencies and reluctance to delegate with others.

- Issues at home (e.g. divorce).

- “Wheeler-dealer” tendencies.

5. Data monitoring and analysis combined with surprise audits reduce fraud loss by more than 50%.

Surprise audits and data monitoring are a powerful combination according to ACFE’s 2018 findings. Together, these contributed to significant reductions in fraud loss. When in place, proactive data monitoring and surprise audits got fraud cases under control in approximately half the time. Compared to cases where these controls were not in place, it reduced fraud losses by more than half.

Despite their effectiveness, neither proactive data analysis nor surprise audits tops the list for commonly used fraud control measures, each were only used by 37% of the companies examined in the 2018 study.

6. Weak internal security was responsible for almost half of the fraud instances.

Internal security can be a valuable line of defense for companies. When companies were asked about what opened the doors to fraud, 30% cited insufficient fraud controls as the top enabler. While 19% said that their systems were too weak and therefore overly easy for fraudsters to override.

7. Fraudsters who had been employed for more than 5 years stole twice as much.

According to the ACFE, employee tenure correlates with median fraud losses. The study found that fraudsters who had been a company for more than five years stole twice as much than relatively newer employees: $200K median loss versus $100K. Employees at a company for less than a year posed notably the least risk to companies, incurring median losses of $40K.

8. Collusion between two perpetrators doubles the loss.

Collusion is common in occupational fraud: 49% of cases investigated in ACFE’s study involved more than one fraudster. This holds especially true when executives and owners are involved – occurring in 66% of cases instigated by higher ups.

The involvement of multiple perpetrators is also more costly. The median loss in cases with one perpetrator was $74K, whereas that number rose to $150K for two perpetrators, and up to $339K when three or more were involved.

When it comes to occupational fraud, prevention and detection requires ongoing, diligent efforts. Whether it’s through surprise audits or providing channels for informants to report suspicious behavior, the team at Lowers & Associates can help establish your fraud prevention plan. Talk to a risk management expert today.