Fighting Fraud in Your Organization

This week, we were proud to support the ACFE’s International Fraud Awareness Week — a global effort to minimize the impact of fraud by promoting anti-fraud awareness and education. As we wrap up our Fraud Awareness Week series, Fraud Stories and Lessons Learned, it is a pleasure to end the week with a message from Jon Groussman, President of Lowers & Associates (L&A). In this video, Jon discusses why fraud happens and how L&A works with organizations to detect, investigate, and prevent it.

Watch the video here:

In its 2020 Report to the Nations on Occupational Fraud, the Association of Certified Fraud Examiners (ACFE) conducted the 11th edition of its largest global study on occupational fraud. The report examines how fraud schemes including corruption, asset misappropriation, and financial statement fraud are committed and how they are detected. It also looks at the profile of both victim organizations and perpetrators.

Some notable findings from the ACFE Report include:

- Organizations lose an estimated 5% of revenue each year to fraud.

- 21% of cases caused losses of $1 million or more.

- Asset misappropriation is the most common category of fraud experienced by organizations.

- The median duration of a fraud is 14 months.

- Financial statement fraud has the greatest velocity (median loss per month) at $39,800 per month.

- Most commonly, fraudsters conceal their crimes by creating or altering physical or digital documents or files.

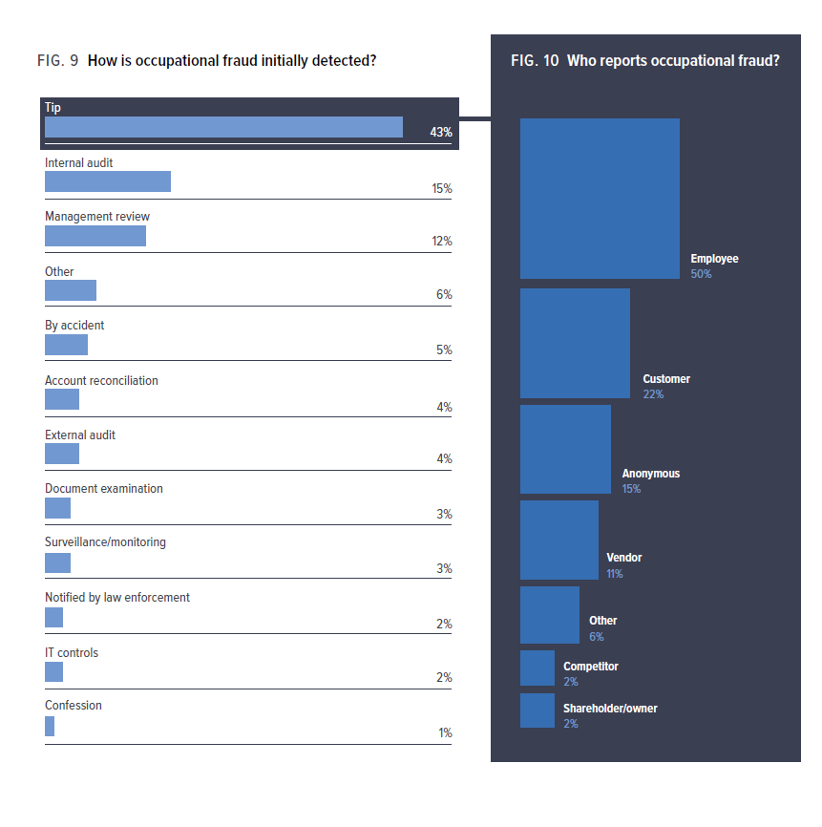

- Tips by employees, customers, anonymous sources, and others are the most common way fraud is initially detected.

- 70% of fraud occurred in for-profit organizations.

- Small businesses (those with fewer than 100 employees) had the highest median loss of $150,000.

- Billing schemes occurred at almost twice the rate in small businesses compared to larger organizations. Check and payment tampering was nearly four times more common at small companies.

- Corruption and noncash schemes occurred more frequently in larger organizations.

- Only approximately half of the victim organizations in the ACFE study undertook background checks on their employees.

- The longer a perpetrator works for a company, the more damage that person’s fraud scheme causes.

- Manager-level perpetrators are more likely to override existing controls.

- 85% of all fraudsters displayed at least one behavioral red flag while committing their crimes.

- Most organizations (54%) in the ACFE study did not recover any of their losses.

Adding perspective from fellow Lowers Risk Group company, Lowers Forensics International, Henry Dicker has this to say about fighting fraud: “One thing is constant: Accounting fraud is always a surprise. Our clients say, ‘We never saw it happening.’ Solid internal controls, implemented and followed diligently, are the best deterrent to fraud. Additionally, continually maintaining and testing your internal controls, performing internal audits of high-risk areas, and monitoring non-financial measures is crucial. Forensic Accountants are a valuable resource to have on your side to help safeguard your data and investigate losses when fraud strikes.”

To discuss your fraud prevention program with an expert, we invite you to reach out to Lowers & Associates here.