Due Diligence: Your Lucky Day?

Imagine your business is being asked to partner with the trendiest new luxury goods distributor. They have a strong presence throughout Europe, are establishing a growing network of suppliers, and come backed by some significant capital. Wow! It MUST be your lucky day!

Or is it? A quick look into the distributor’s leadership reveals that the principal supplying that capital is best known for stepping down as the founder and CEO of his previous business after multiple Lacey Act violations, including unethical sourcing and the sale of dangerous, toxic products. These violations cost his previous company millions in criminal penalties.

Not to ruin the fantasy here, but this is the real world (and a true story). Proper due diligence saved the business from this bad partnership before it could happen. It truly was their lucky day.

This positive outcome is less common than you might think. Fraud is everywhere, but just a small amount of basic due diligence can help a business avoid it or other unnecessary risks. From a small-town pawnbroker that lost his business after hiring a friend whose felonious past was only revealed after a six-figure theft, to a multinational corporation that lost millions in fraudulent payments to a duplicitous supply contractor living well beyond his means, there are countless stories demonstrating the steep price paid by companies that trusted before verifying.

What is due diligence?

Due diligence is a specific but flexible process performed by qualified experts to identify and obtain disparate information to form a complete picture. In the above example, the research would have included the history and business filings of the company (as well as those of the principles, owners or key management) and any actual or perceived affiliations, to name a few.

Why do businesses need it?

New personnel or new partners can shape the future of your business. Whether it’s a college coach, a board member or a supplier, the whole story matters and should include:

- Investigation of Character

- Investments

- Acquisitions

- Mergers

- Assets identification (for debt enforcement and recovery)

- Location

What else should I know about due diligence?

It’s always important to understand who you’re working with to eliminate the potential for fraud. When doing your due diligence, here are some best practices to consider:

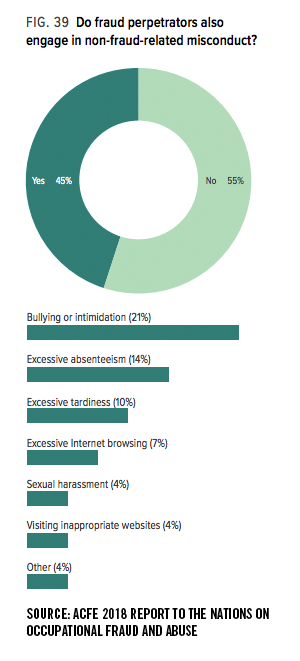

- Access to public records. A subject’s criminal record (or lack thereof) is of prime importance, but equally significant may be history of litigation or bankruptcy. Even seemingly minor issues like traffic infractions may be indicative, especially when a subject has tallied dozens.

- Complete and comprehensive history. The most thorough background investigations can reveal the truth of what’s been put forward in a resume or MOU and what may have been deliberately omitted. Ask the questions that illuminate the answer.

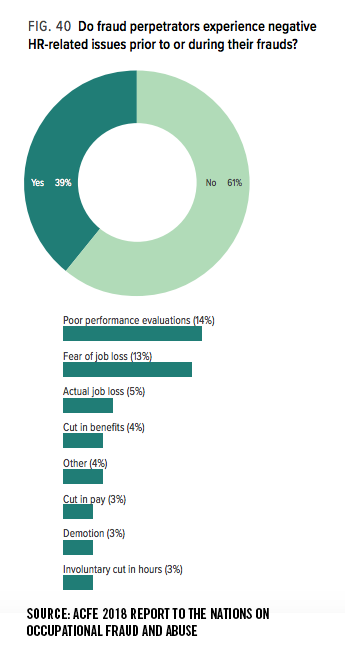

- Asset verification. Before entering into any formal arrangement, understand and confirm a potential partner’s claimed resources and reveal when things don’t add up. Don’t underestimate the power of pressure in the Fraud Triangle.

- Social media review. Despite its prevalence, not everyone uses it wisely. A review of both personal and corporate profiles can identify some of the most egregious red flags. Consider recurring sweeps to mitigate or uncover your exposure.

BONUS: Red Flags

Incompetence is often much more apparent than criminal activity. When evaluating a person or vendor, does your due diligence evaluation include the following?

- History of mismanagement

- Jumping from job to job

- Living beyond perceived means

- Having a history of “start-ups” or serial entrepreneurial ventures

- Relocation, either town to town, or state to state

- Longer and undefined timeframes with no employment

If your business is struggling with due diligence or would like to set up a consultation in-person or remotely, please reach out to us.