5 Places Where the Human Element of Risk Rears Its Ugly Head

A perfect storm of human errors — six of them to be exact — caused the biggest nuclear accident to date, the Chernobyl disaster in 1986. An IT mistake prompted 425 million Microsoft Azure users to experience 10.5 hours of downtime. Lack of communication between maintenance crews caused what would have been a simple fix to, instead, lead to the crash of a 1.4 billion dollar stealth bomber.

While there are many sources of enterprise risk, probably the most dynamic and difficult to contend with are those driven by or otherwise impacted by human capital — that is, people. The fact is, most risks start and end with people. The decisions people make, how they perceive situations, how closely they follow policies and procedures… these and other human-driven factors can significantly influence how risks are identified, managed, and addressed.

In our work in the realm of human capital risk, we see many areas where people have the potential to positively or negatively impact the organization from a risk management standpoint. Unfortunately, when people fail, they sometimes fail in big ways. Here are some of the places where human capital risk can rear its head, causing damage to people, brands, and profits:

1. Cybersecurity

Staying secure goes beyond technology (think servers, network, firewalls, etc.); it requires the aid of humans to maintain that secure digital environment. And while most employees get some degree of IT security awareness training in the course of their jobs, mistakes still happen.

IBM estimates the average number of records lost to data breaches annually to be 25,575, and the average cost per breach of USD $3.92 million. Social engineering, malware, and phishing attempts continue to pay dividends for the fraudsters who deploy them. We all know we’re not supposed to click on that link or divulge sensitive information over the phone, but still, people do it. Lapses in judgment, failure to follow a process, having a sense of overconfidence or the feeling that it won’t happen to them, whatever the reason, humans have the ability to sidestep even the strongest cybersecurity protocols.

2. Occupational Fraud

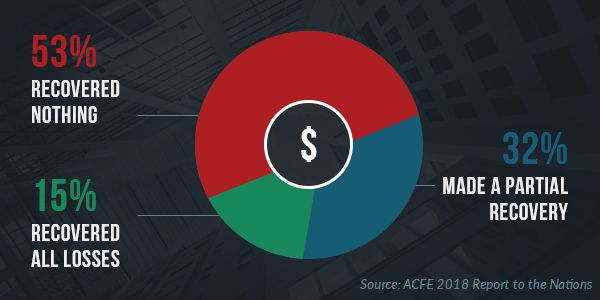

Risk doesn’t always stem from human error; sometimes it’s the result of deliberate actions by employees. Common types of occupational fraud include asset misappropriation, corruption, and financial statement fraud. In 2017, these types of fraudulent activities resulted in $7 billion in losses, according to ACFE’s 2018 Report to the Nations.

When the workplace lacks internal controls, fails to have separation of duties, or neglects to invest in data monitoring and technologies that could flag anomalies, unscrupulous employees see their opening. Bookkeepers set up fictitious employees in payroll systems in order to cut checks, executives find ways to alter records and financial statements, and line workers take home company property for personal use. These incidents have a median per-loss cost of $114,000, as noted in the ACFE Report.

3. Physical Security

Check with most workplaces and you’ll find they have certain security protocols in place or at least policies that address physical security. Visitors may be asked to check-in at a front desk, employees might be required to wear ID badges, and doors might be required to be locked at all times.

Unfortunately, over time, employees become complacent and policies become outdated. People forget, or simply choose to ignore, the basics they’ve been taught. They leave doors propped open, inviting strangers to come in the building. They neglect to report a broken lock or missing lightbulb. They forget to keep up their annual emergency exit drill schedule. Or, they fail to log off a computer just as someone else decides it’s okay to let a guest circumvent the front desk sign-in because they “know this person.”

These small, but meaningful, errors in judgment often mean the difference between a workplace that remains physically secure and one that opens itself to the risks of theft, data breaches, or even active shooter situations.

4. Workplace Violence

Workplace assaults resulted in 18,400 injuries and illnesses and 458 fatalities in 2017. Assaults range in severity from threats and verbal assault to stabbings, rape, and intentional shootings. In fact, mass shootings at workplaces, schools, and public venues have become the new norm with an average of at least one happening per day in the United States.

We can’t always know which employees are at high risk for engaging in workplace violence, but experts have begun to identify the behaviors that often precede events like these. They include the inability to focus, crying, social isolation, threatening behavior, concerning posts on social media, or complaints of unfair personal treatment. A sudden change in behavioral patterns, or in the frequency or intensity of these behaviors, is also a red flag.

5. Negligent Hiring and Retention

Exercising due diligence in hiring is the best line of defense against negligent hiring and retention lawsuits. Background checks, of course, are the first course of action in rooting out applicants who might disproportionately introduce risk into the workplace. Gathering criminal background records, doing drug testing (as appropriate), and verifying references and credentials are all critical to mitigating your hiring risks.

Beyond background checks, organizations need to have effective fraud detection methods in place. This is particularly relevant considering 96 percent of fraud perpetrators had no prior fraud conviction, and fraudsters who were employed for more than five years stole twice as much, $200,000 vs $100,000 for newer employees! They need to understand the elements of human risk that can be an early indicator of fraudulent activity, including employees who live beyond their means, are experiencing financial difficulties, or have an unwillingness to share job duties.

Manage Your People, Manage Your Risk

Humans are, well, human. They introduce a spectrum of risk into any workplace, from purposeful criminal behavior on one side to unintentional, garden-variety mistakes on the other.

Managing those risks is an ongoing challenge, particularly when it’s difficult to pinpoint the precise human factors that contribute to failures. If you’d like help identifying those areas in your organization that are most susceptible to the human element of risk – whether it’s your cybersecurity program or your hiring processes — request a meeting with a risk management professional.